by Patrick Marren

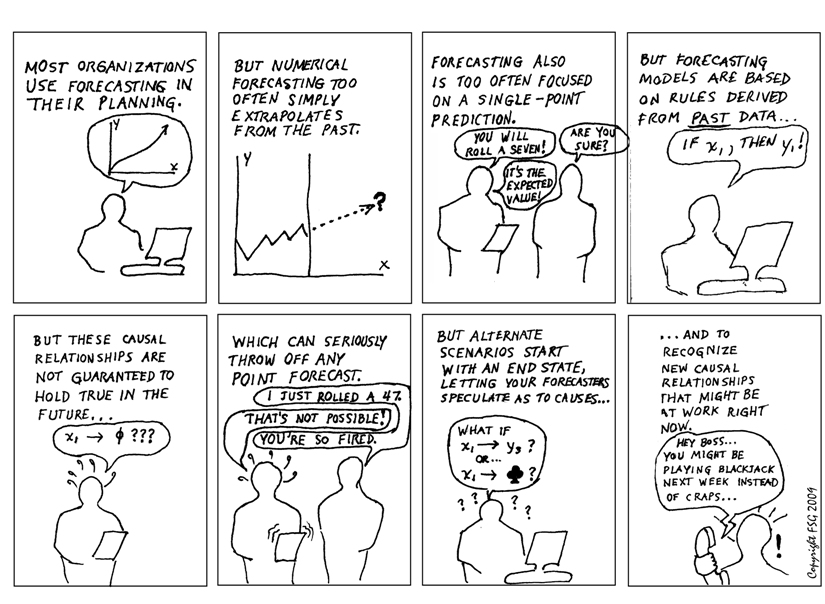

Forecasting is based on expert opinion. Expert opinion, in turn, is essentially a collection of “if-then” statements about how causality works in one’s sphere of expertise. These “if-then” statements, it should be noted, are all based upon observation of how things have worked in the past. Hence, forecasting is based on how things have seemed to work in the past.

In addition, forecasting cannot take into account the full range of possible factors that could affect the actual value of the quantity you are forecasting. The world is an infinitely various place, and spreadsheet equations are not capable of incorporating an infinity of possible variables. Something is always left out; the equation in the spreadsheet is always an approximation, and leaves out important aspects of reality. Yet attempts to remedy this shortfall by adding detail may cause a different type of error: the more detailed the equation is, the larger the number of assumptions that are involved, and the larger the built-in inaccuracy.

Now, forecasting is absolutely necessary, and is particularly appropriate for short-term projections in relatively controllable environments. You clearly cannot completely ignore the past, and a rigorous understanding of past causal relationships is a very good thing.

Far too often, however, forecasts are made to perform a function for which they are not designed: in the most literal sense, risk management. An expert forecast is essentially a mathematical function, based on expert opinion about past causal relationships, that attempts to predict a quantity or quantities of interest. Often this prediction is rendered very precisely, giving the reader a false sense of reduced uncertainty. Unfortunately, the two sources of error identified above – the internal error caused by multiplication of assumptions, and the (often far more significant) external error caused by complete neglect of some factor that is not even included in the equation – far too often render the forecast comically inaccurate.

The problem with spreadsheet forecasts is that these two sources of error are almost never transparent to the consumer of the forecast. The many internal causal assumptions built into the actual equations behind the spreadsheet are usually literally hidden within the spreadsheet. And potential external factors are obviously imponderable, since they are left completely out of the analysis.

Throw in the fact that past causal relationships may not hold good in the future, and that complete reliance on point forecasts “bets the farm” on one single point out of an infinite number of possible futures, and you can see why point forecasts of the future can be such a risky way to deal with future uncertainty.

The only way to break out of the straitjacket of standard point forecasting is to identify the most critical assumptions upon which your business depends, and simply to posit changes in these assumptions for the future – to create alternative scenarios. THEN bring the experts in, and have them ask themselves, “How could these scenarios possibly have arisen?” Causal explanations for unexpected scenarios will always be some combination of previously unappreciated potential for internal error in the rigorous assumptions behind the previous standard forecast, and external potential error – an overwhelming of the accepted causal spreadsheet model by previously unimagined outside factors.

Notice that this different way of appreciating the full range of future uncertainty is not incompatible with forecasting. In fact, it just might sharpen your forecasts and make them more useful – and conversely, forecasting techniques can also be used within alternative scenarios, to lend the scenarios rigor and to engage your forecasting staff in the scenario effort. This is true “risk management.”

Reverse the causality. Simply accept the possibility of unexpected alternative futures – and then have your forecasting experts spin stories about how they might have come about. In this way, you not only may gain a better understanding of the full range of how things might turn out in the future; you may actually gain immediate insight into how your world may be changing right now, and what you need to be doing about it – today.

Patrick Marren is an FSG principal.

You’re right, the missing

You’re right, the missing variables in the ‘spreadsheet models’ have a high probability of creeping up and derailing things. I remember being impressed by how this was addressed in FSG’s work in Project Horizon.

There’s the related problem, though, of error accumulating every time you make a linear prediction. Do enough of them and you end up with mathematically-determined incorrect conclusions. Working backwards from possible conclusions to antecedents makes huge strategic sense.